Testosterone and Competitive Decision making under Risk

Nathaniel Phillips, Joerg Rieskamp

27 February 2017

Research Questions

- How does testosterone affect decision making under risk in competitive tasks?

- Under what conditions (both social and environmental), can testosterone improve outcomes for individuals, and groups, and when does it hurt?

T Literature Review

- Testosterone moderates the serach for, and maintenance of, social status (Eisenegger, Haushofer & Fehr, 2011)

- T measurements correlate positively with high dominance, power motivation, and vigilance against status threats.

- T levels rise (in minutes) in anticipation of physical and non-physical competitive situations (Salvador, 2005), and when people win competitions (Oliveira et al, 2009).

- T increases concern for social status. In the ultimatum game, T increases the fairness of offers – perhaps to decrease the chance of rejection.

- T increases investments in risky stocks due to increased optimism in price changes (Cueva et al., 2014)

Outstanding questions (from Esenegger et al., 2011)

- Does testosterone influence learning effects in repeated (social) decision-making tasks?

- How does winning or losing a contest interact with exogenously administered testosterone to determine future competitiveness in humans?

- What are the effects of acute single doses of testosterone on social interaction in young men?

Hypotheses

Risk

- T increases risk-seeking, and even more so in competitive environments.

Performance

- In risk-favorable environments where risk-seeking is beneficial, T improves performance.

- In risk-unfavorable environments where risk-seeking is detrimental, T decreases performance.

Experimental Design

IVs:

- 2 Testosterone: Placebo vs. Testosterone x

- 2 Competition: None vs. Yes x

- 2 Environment: Risk-favorable vs risk-unfavorable.

DVs:

- Risk Taking

- Rewards (at both individual and group level)

Risk Predictions

- Competition always increases risk.

- T increases risk in solitary environments, and even more so in competitive environments.

- No interaction with environment

Reward Predictions

- In risk-favorable environments, T and competition increase rewards

- In risk-unfavorable environments, T and competition decrease rewards

3 Paradigms

| Paradigm | Citation |

|---|---|

| Columbia Card Task (Hot v Cold) | Figner, Mackinlay, Wilkening, & Weber (2009) |

| BART (Balloon analogue risk task) (Standard vs. Automatic) | Lejuez et al. (2002) |

| Auctions | Cox, Smith, & Walker (1988) |

BART

Task

- Players pump a balloon until they cash out, or the balloon pops: Risk Measure: Number of balloon pumps

- Versions: Standard: Pumps are decided sequentially, Automatic: Pumps are decided at once (Plekac et al., 2008)

T Research

- The effect of power on risk in the BART is moderated by 2D:4D (Ronay & Hippel, 2010). 2D:4D is correlated with risk in BART (Goudriaan et al., 2010)

Proposed study

- Risk-favorable: Balloons have high popping values vs. Risk-unfavorable: Balloons have low popping points.

- Players are yoked to a partner and are instructed to earn more points across all balloons. Every X balloons (e.g.; 5), players learn if they are winning or losing relative to their partner.

Columbia Card Task

Task

- Players can select cards until they decide to stop, or they select the joker. Risk Measure: Number of cards selected prior to the joker.

Versions

- Hot: Cards are selected sequentially. Cold: Cards are selected all at once.

T Research

- None

Proposed Study

- Risk-favorable: small number of jokers vs. Risk-unfavorable: large number of jokers.

- Players are yoked to a partner and are instructed to earn more points across all games. Every X games (e.g.; 5), players learn if they are winning or losing relative to their partner.

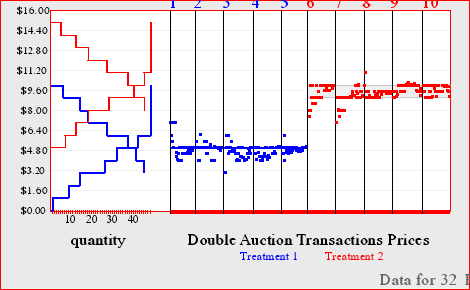

Auction

Task

- Players bid on an asset with an unknown value.

- Types? Sealed vs Open bid, First-price v second-price vs all-pay

T Research

- No correlation between 2D:4D on bidding in a two-bidder first-price sealed-bid auction (Pearson & Schipper, 2012):

- Relationship between testosterone and competitive behavior in a (5 person sealed-bid) auction is strong when cortisol is low, and not significant when cortisol is high. (van den Bos et al., 2013)

Proposed Study

- Players bid on several assets against competitors. Prior to each bid, players receive noisy information about the true value of the asset (see van den Bos et al., 2013)

Proposed Study

IVs:

- 2 Testosterone: Placebo vs. Testosterone x

- 2 Competition: None vs. High x

- 2 Environment: Risk favorable vs risk unfavorable.

DV: Risk Taking

| Paradigm | Time consuming | Clear measure of risk |

|---|---|---|

| Columbia Card Task - Hot | Yes | No |

| Columbia Card Task - Cold | No | Yes |

| BART - Standard | Yes | No |

| BART - Automatic | No | Yes |

| Auction - Open | Yes | No |

| Auction - Closed | No | No |

Questions

- What exactly are our research questions and hypotheses?

- Which paradigm allows us to most easily answer our research questions?

- Aside from Testosterone, what indpendent variables do we want to manipulate?

- Competition: None vs. High.

- Environment: Risk-favorable vs. Risk-unfavorable.

- Should we do pilot testing of a paradigm without the drug manipulation first?